Wild Reversal Follows Historic $600M ICO Frenzy

After staging one of the most explosive breakouts in meme coin history, PUMP price has retraced sharply from its post-sale spike. The token surged to highs above 0.00002000 before collapsing to 0.00000235, a staggering 86% daily decline. Despite the violent move, interest in Pump.fun remains elevated following its $1.32 billion total raise, placing it among the largest ICOs on record.

What’s Happening With PUMP’s Price?

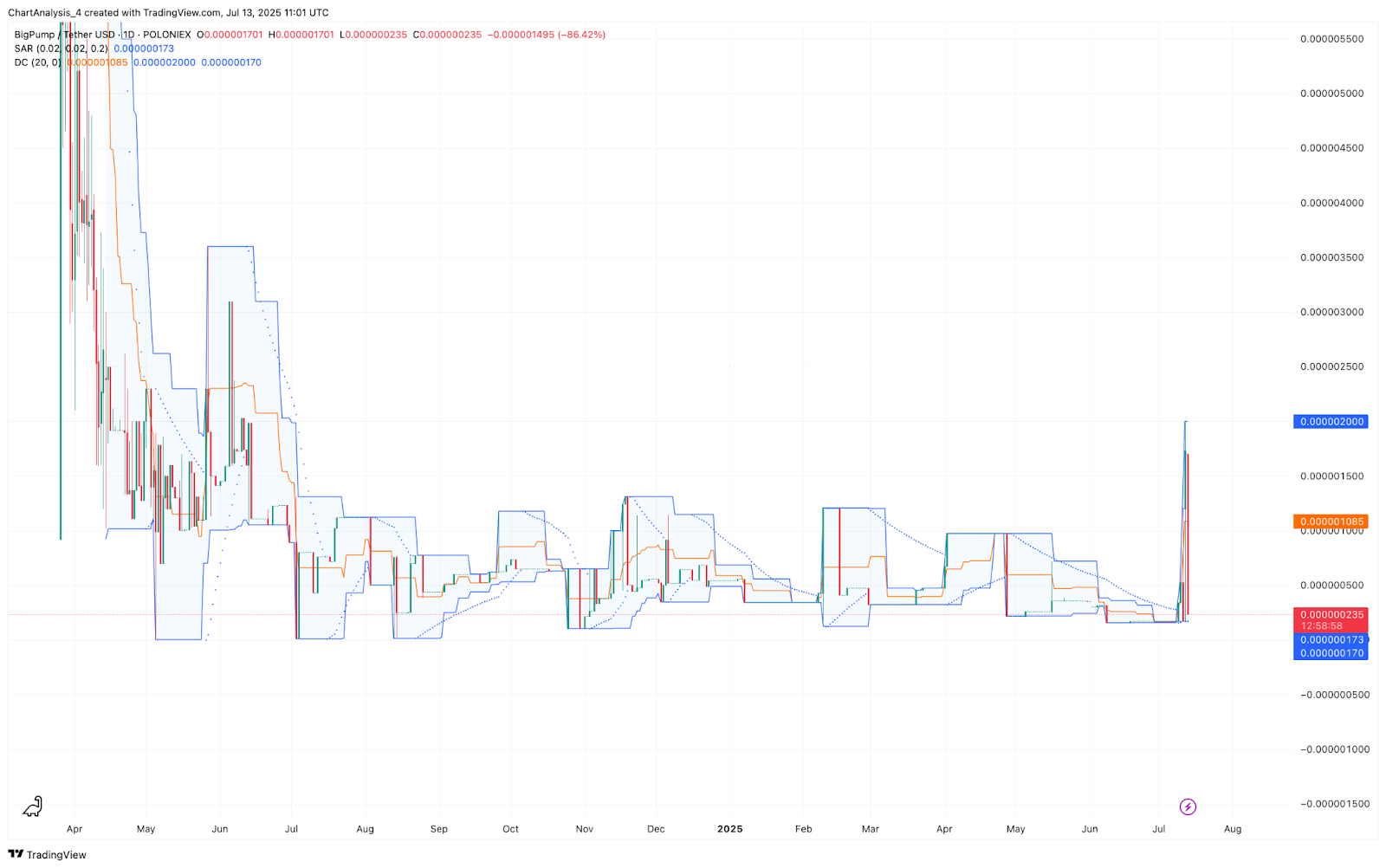

PUMP price dynamics (Source: TradingView)

Pump.fun price today reflects the volatile aftermath of an overhyped public sale. After listing on July 12 via Gate, PUMP soared vertically within hours, tapping the 0.00002000 zone before extreme profit-taking reversed the entire move. The daily chart shows a long upper wick, a clear sign of speculative blowoff, followed by a full retracement to prior range support at 0.00000235.

Technically, this pullback returns price to just above the descending trendline resistance-turned-support. This level also aligns with the high-volume node from May, suggesting some structure beneath the current collapse.

Why Is The PUMP Price Going Down Today?

The dramatic drop in PUMP price today is driven by classic post-ICO volatility and meme coin market dynamics. While Pump.fun raised over $600 million in just 12 minutes, with 150 billion tokens sold publicly and 180 billion distributed to private investors, the sudden availability of supply unleashed a wave of selling.

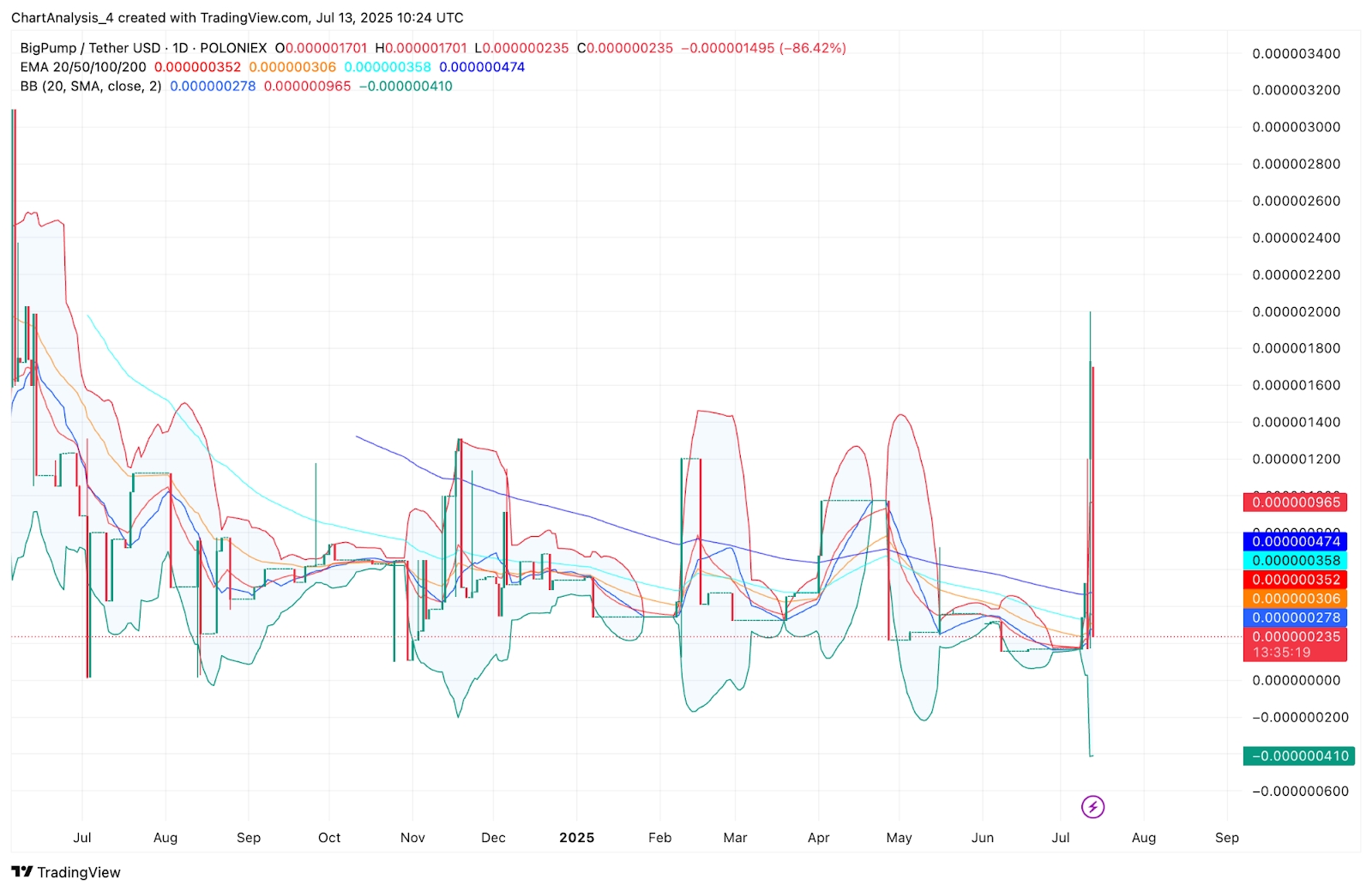

PUMP price dynamics (Source: TradingView)

The MACD on the daily timeframe remains technically bullish, with the histogram in positive territory and MACD line still above signal. However, RSI has collapsed back to neutral at 48.7 from its earlier spike above 70, confirming the cool-off. This reflects a massive sentiment reversal after the speculative high.

PUMP price dynamics (Source: TradingView)

Moreover, Ichimoku analysis shows PUMP has fallen below its conversion and base lines, while the daily candle now trades inside the cloud, suggesting increasing indecision. Donchian Channels and SAR levels are above price, indicating resistance could cap short-term upside.

Bollinger Bands, EMAs and Trend Structure Hint at Mean Reversion

PUMP price dynamics (Source: TradingView)

The Bollinger Bands have widened dramatically after the spike, and price now sits near the lower mid-band zone. This suggests PUMP is entering a mean reversion phase, where volatility may compress before the next major move. All key EMAs i.e 20/50/100/200, sit well above current price, forming a thick overhead resistance block from 0.00000306 to 0.00000474.

The daily structure is reminiscent of previous meme coin blowoffs, with a vertical pump followed by a full retracement. However, due to strong public sale participation and continued ecosystem engagement (such as the Kolscan acquisition), sentiment may recover if support holds above 0.00000200.

PUMP Price Prediction: Short-Term Outlook (24H)

With Pump.fun price retracing toward historical support, two scenarios are in focus. If buyers defend the 0.00000200–0.00000235 zone, a relief bounce could push price toward 0.00000350–0.00000410, which coincides with Bollinger midline and EMA20 levels. However, failure to hold above 0.00000200 risks a slide toward the 0.00000170–0.00000160 region — the base from where the recent pump began.

Given ongoing public sale demand and intense meme coin interest, sentiment remains speculative. Price stabilization around 0.00000200 would likely attract short-term traders targeting a volatility rebound, while larger investors may wait for clear consolidation before re-entering.

Pump.fun Price Forecast Table: July 14, 2025

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.