Record Bitcoin Prices Fail to Spark Search Frenzy, Google Trends Data Shows

While bitcoin hovers near record-breaking highs, data pulled from Google Trends shows that public curiosity about the top crypto asset remains surprisingly low.

$119K Bitcoin and Crickets—Where’s the Retail Mania?

On Sunday, bitcoin (BTC) broke into the $119,000 territory, notching a new all-time high of $119,444 on the crypto exchange Bitstamp. Throughout the week, BTC has hit multiple fresh peaks after blasting past the $112,000 level and rebounding sharply upward. Yet despite the price action, interest measured by Google search activity hasn’t reached the same fever pitch seen during the 2021 and 2017 bull runs.

Google Trends, Google’s free analytics tool for tracking search interest over time and by region, paints a cooler picture. When analyzing the keyword “bitcoin” over the past five years, the search term scores a 24 out of 100.

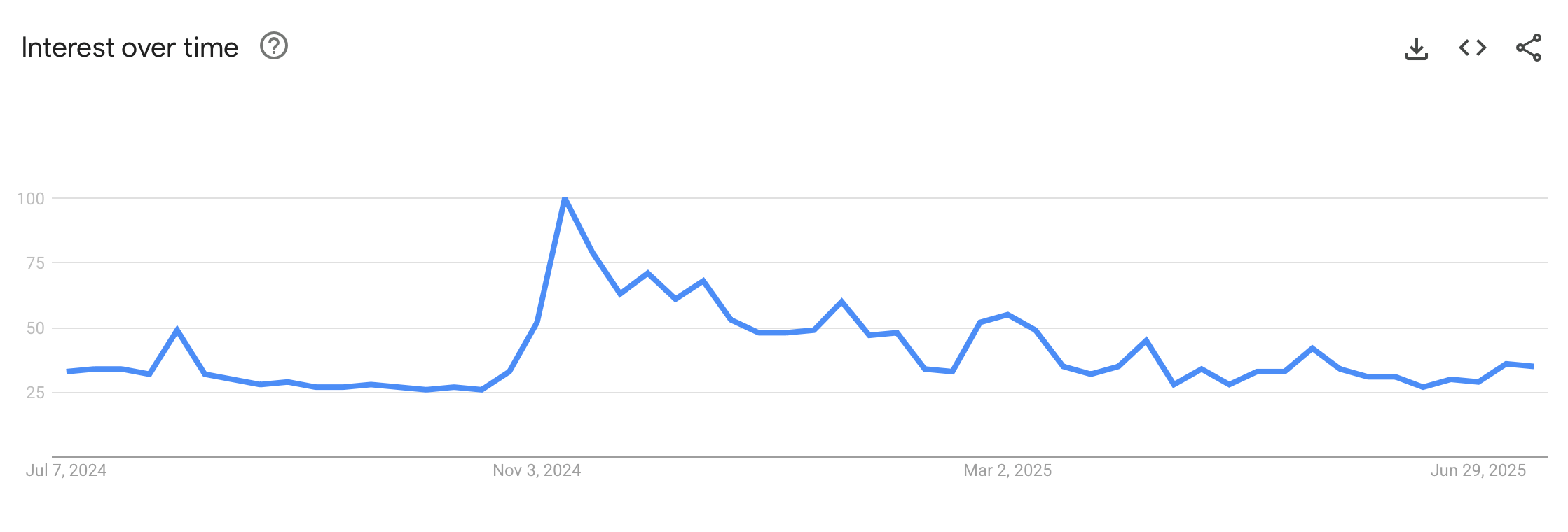

Google Trends chart for the search term “bitcoin” over the five-year span on July 13, 2025.

In Google Trends, a score of 100 signals the term’s highest point of popularity in the selected time frame and location. For “bitcoin,” that peak came in May 2021. Over the past 12 months, the query clocks in at 35 out of 100—a modest level. However, as the timeline narrows, interest does tick higher, suggesting curiosity is growing, albeit at a slower pace.

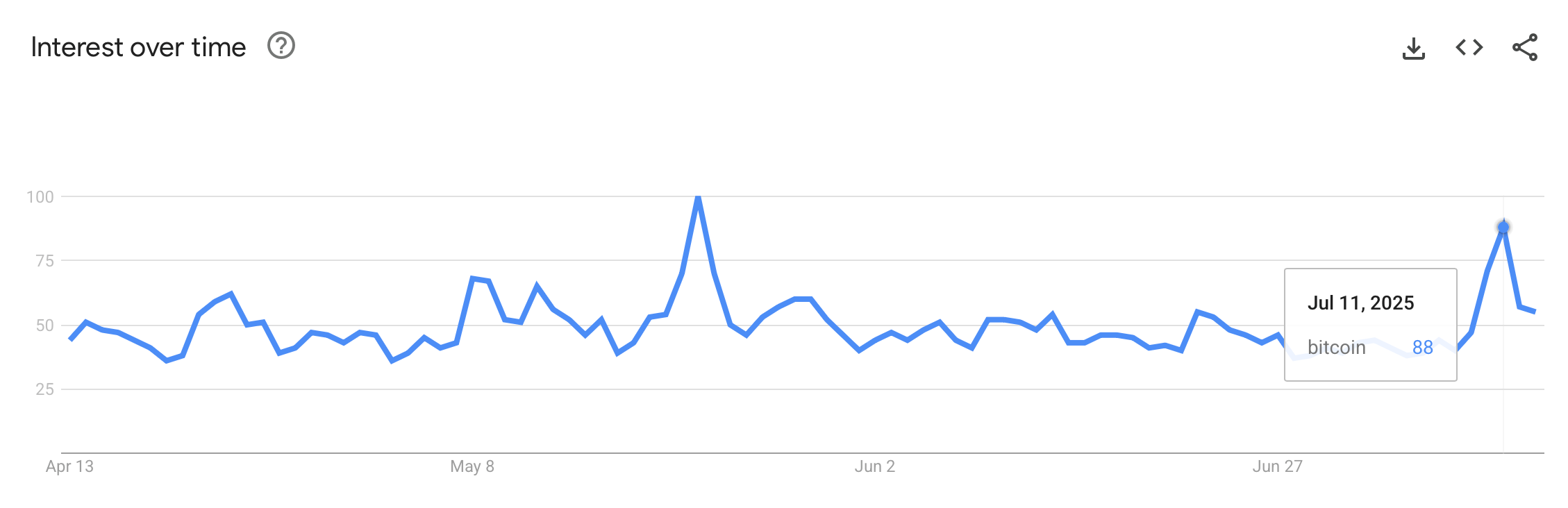

Google Trends chart for the search term “bitcoin” over a 1-year span on July 13, 2025.

For example, over the 90-day span on Google Trends, interest in bitcoin climbed to 88 on July 11, 2025. The most recent peak of 100 on that timeframe occurred back on May 22, 2025. As of today, July 13, the score has cooled to 55 out of 100. Within this three-month view, the countries showing the most enthusiasm for bitcoin are El Salvador, Switzerland, Nigeria, Austria, and the Netherlands.

Google Trends chart for the search term “bitcoin” over a 90-day span on July 13, 2025.

Some observers believe bitcoin’s towering price tag may be scaring off would-be newcomers. With headlines touting six-figure valuations, it’s easy to see why many assume they’ve missed the boat or that owning bitcoin requires a massive upfront investment. The sticker shock alone might explain the subdued search interest despite the asset’s explosive price trajectory.

But that perception is misleading. Bitcoin is divisible down to eight decimal places, meaning anyone can buy a fraction of a coin—no need to fork over $119,000. This divisibility allows users to participate in the counter-economy at any scale, whether it’s $10 or $10,000. Bitcoin isn’t just for whales—it’s for anyone seeking an alternative to traditional financial (TradFi) systems and a hedge against fiat value depreciation.

Bitcoin’s price may be rewriting records, but the relatively muted search data hints at a market moving with less retail frenzy and more measured conviction. Whether this signals a shift toward broader adoption or simply a quieter phase in bitcoin’s evolution remains to be seen. Either way, price alone no longer seems to be the main driver of public interest.