People Are Lining Up To Buy Gold – Is Bitcoin Losing Retail Demand?

It’s not the new iPhone causing lines around city blocks this week, but gold. From Singapore to Sydney, and even Vietnam, crowds of retail buyers are queuing outside bullion shops to purchase physical gold and silver, many arriving before sunrise.

As bullion prices hit record highs and gold’s total market capitalization surpasses $30 trillion, investors appear caught in a frenzy that analysts say could mark the asset’s “macro top.” Meanwhile, Bitcoin proponents ask the same question: Is retail missing the next rotation into digital gold?

Gold Fever Goes Global: Retail Queues Signal Market Euphoria as Bitcoin Waits Its Turn

The frenzy is seen in viral videos from BullionStar in Singapore, which show customers lining up before opening hours.

Scene at BullionStar before Opening Hours – Customers already lining up to buy Gold & Silver. pic.twitter.com/UVyqLoWMXR

— BullionStar (@BullionStar) October 17, 2025

The scene is replicated in other parts of the world. Pictures from Sydney show similar lines outside ABC Bullion, one of Australia’s largest dealers. Some of this demand is spilling over to silver, with interest reportedly spread across different age brackets.

“It’s not just Gold, people are also buying silver. I stood around the shop in Martin Place for over 2 hours. There were a lot of young people in the crowd. Although the demographic was largely people above 40 in the area I went to, you could also see many young people in their 20s in the crowd,” one Sydney local told BeInCrypto.

People lining up to buy gold and silver in Sydney. Source: Tom Richardson on X

In Vietnam, Chay Bowes reported that people line up from dawn to buy gold. Some gold shops in the country have also announced that they have no more gold to sell.

The retail FOMO (fear of missing out) compels “Temporarily out of gold for sale” signage at some of the largest gold systems in Vietnam.

“Notice: Temporarily Out of Stock — All Thang Long 999.9 Gold Bars and Bullion Products”

Signs from Vietnamese gold dealers Bảo Tín Minh Châu and Phú Quý announce that their gold bullion products are completely sold out, reflecting a nationwide rush for physical gold.

This “herd mentality” extends beyond Australia and Vietnam, where people queue for multiple hours. According to Bloomberg, Japan’s top gold retailer says it is unable to keep up with the demand.

“We are strengthening our production system to quickly resume stable supply to customers,” Bloomberg reported, citing Tanaka Precious Metal Group Co.

The buying spree comes only months after a pro-gold legislation in Florida. Governor Ron DeSantis signed a bill to allow gold and silver coins to become legal tender and sales tax–exempt starting July 2026.

From defunding ESG to fighting de-banking, we’ve taken actions to protect Floridians from the push for more centralized control over currency and transactions. Today, I was pleased to sign HB 999, through which Florida will exercise its authority under the U.S. Constitution to… pic.twitter.com/MZpwbbHdC8

— Ron DeSantis (@GovRonDeSantis) May 27, 2025

However, even as FOMO hits the roof, analysts call for caution. As retail psychology rarely changes, some could be caught in exit liquidity.

“And soon it’ll be lines for people selling it back,” wrote IncomeSharks.

Signs of Euphoria and “Blowoff Top”

Market veterans are sounding alarms about the mania. Trader Mayne called the rally “long in the tooth,” noting that “Peter Schiff [is] reaching insane levels of insufferability and people are lining up to buy physical gold.

“I’m thinking the top is close,” he warned.

Other analysts see classic top signals forming as people line up to buy physical gold when it is in the most expensive form to sell.

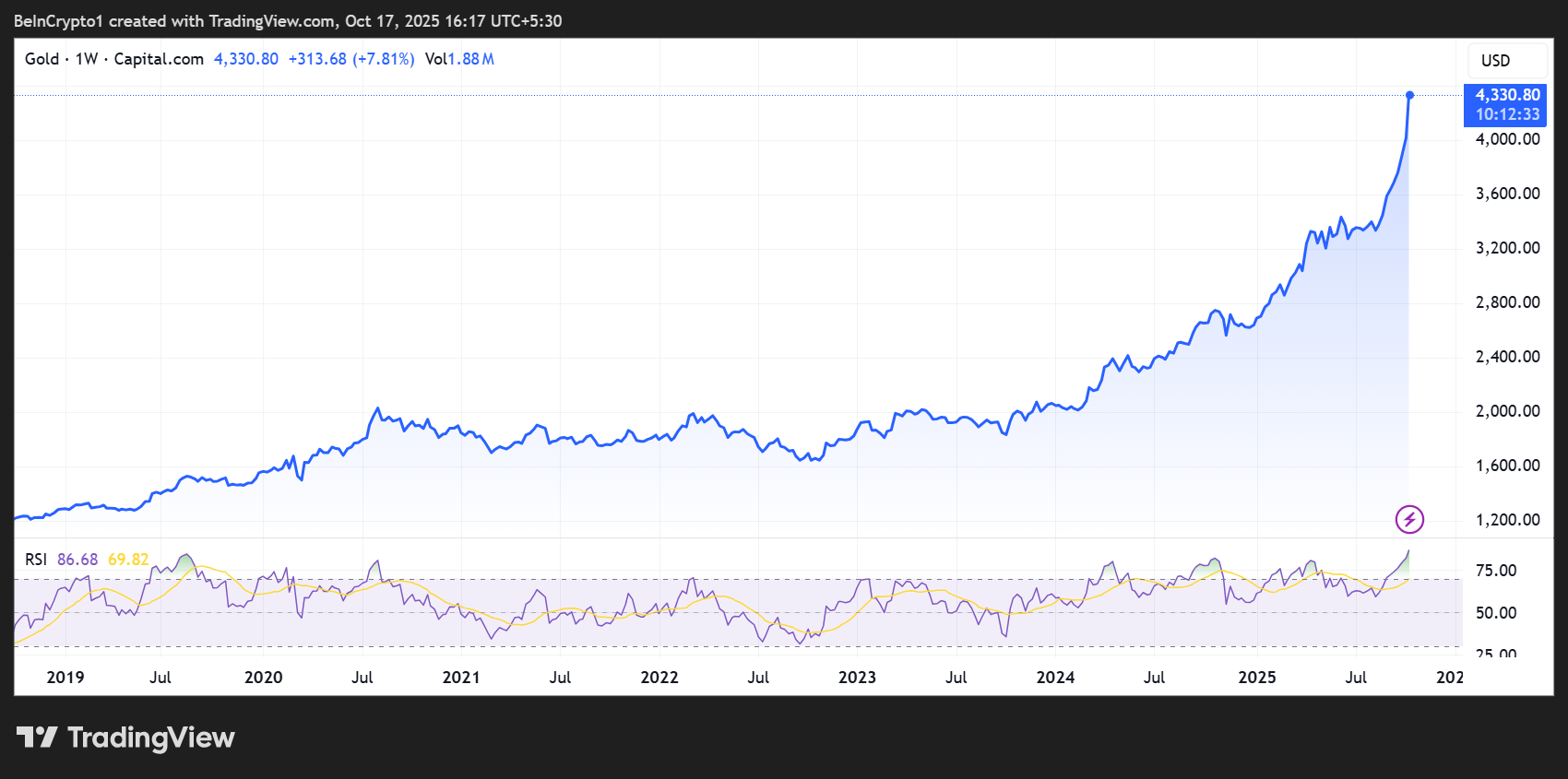

As of this writing, gold was trading for $4,330, its all-time high, with the RSI (Relative Strength Index) showing parabolic momentum.

Gold Price Performance. Source: TradingView

“This is what retail FOMO looks like! Hundreds of people lining up… to buy $GOLD literally at the top. The top signal couldn’t be clearer. #Bitcoin still needs to go higher before the crowd rushes in,” one analyst noted.

Analysts Anticipate Bitcoin’s Rotation Moment

Gold’s parabolic move comes as the metal achieves an unprecedented $30.154 trillion market cap, making it the first asset in history to do so. However, several analysts suggest that this retail gold euphoria could precede a liquidity rotation into crypto.

“Gold has now reached the euphoria phase. It should make a local top within 2 weeks around 29th Oct FOMC, and then we will see a massive liquidity rotation into Bitcoin. Trillions are coming into crypto market and we will see the BIGGEST BULL RUN EVER,” Ash Crypto predicted.

Similarly, another renowned analyst, Jelle, forecasted an incoming new rotation to digital gold, referring to Bitcoin.

Gold going absolutely crazy, people standing in line at the Bullion stores, and Peter Schiff is deepthroating himself.

Time for a new rotation to digital gold?

Either way, makes sense to see profits flow out of Gold soon with the way the market behaves.$BTC pic.twitter.com/XCQ6PYVxVt

— Jelle (@CryptoJelleNL) October 17, 2025

However, in as much as such buyer frenzy presents as a leading indicator that the asset could crash soon, macro uncertainty related to President Trump could see the gold rush last longer, potentially even as long as 2-3 years.

The post People Are Lining Up To Buy Gold – Is Bitcoin Losing Retail Demand? appeared first on BeInCrypto.