Global Push for RWA Tokenization in 2025 Could Boost XRP and XLM Adoption

- On-chain tokenized assets hit nearly $28 billion, with Stellar and XRP showing rapid growth.

- Visa tie-ups, U.S. Treasuries, and global regulations fuel institutional trust in tokenized finance.

The tokenization of real-world assets (RWAs) has accelerated strongly in 2025, with on-chain values reaching $27.95 billion, representing a growth of 7.39% in just one month. Ethereum continues to dominate with $8.3 billion, but Stellar and XRP Ledger are showing fast-rising adoption.

Stellar now has over $511 million in tokenized assets, representing a growth of 12.87% over the past 30 days. XRP Ledger follows with $322 million, exhibiting growth of 12.01% in the same period. Their respective market shares of 3.26% and 2.06% suggest both networks are gaining traction as adoption rises.

Source: rwa.xyz

Stellar and Ripple Target Trillions in Tokenization

Institutional adoption is a prime driver for Stellar. Its integration with Visa’s stablecoin platform and focus on cross-border payments have positioned it as a trusted infrastructure. The September 2025 rollout of Protocol 23, which will introduce parallel transactions, is likely to boost scalability.

The Stellar Development Foundation has additionally allied with the ERC-3643 Association to support standardized tokenization protocols. The network now supports assets such as PayPal’s PYUSD and EURCV, alongside USDC, which has around $170 million circulating on Stellar. Franklin Templeton’s tokenization of U.S. Treasuries on Stellar is another sign of traditional finance entering digital rails.

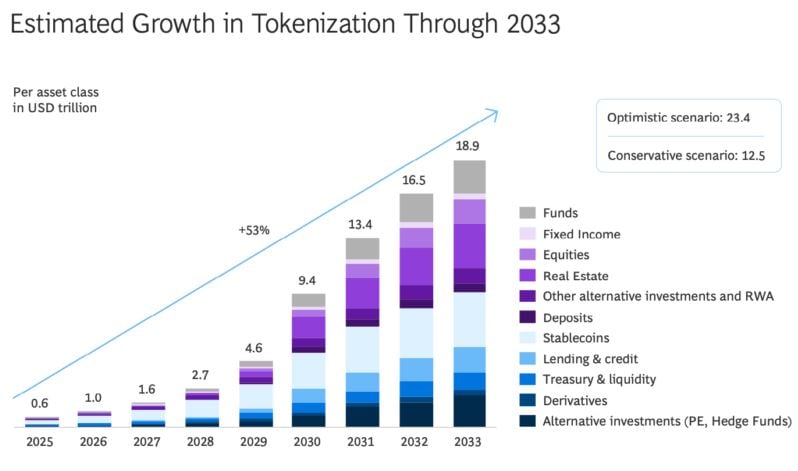

Ripple’s XRP Ledger is also gaining strength. With $322 million-worth of tokenized assets already in use, the ledger is becoming a compliance-friendly institutional system. Ripple is expecting 19 trillion in tokenized assets by 2033, reflecting long-term objectives.

The XRP Ledger handles up to 1,500 transactions every second and has made upgrades to its ecosystem through updates like XLS-30 AMM and interoperability with Wormhole. Over 120 partnerships, like American Express and Santander, connect XRPL to global banking organizations. Ripple’s acquisition of Hidden Road has further reduced pre-funding requirements, improving cross-border settlement efficiency.

Global Regulatory Push Fuels Growth

At the same time, Asia, Europe, and Gulf nations are proceeding to provide favorable circumstances for tokenization growth. Hong Kong, the UAE, and Singapore have already laid down clear rules for tokenized assets, while Europe’s MiCA framework offers a continental regulatory template. The U.S. has added further momentum to this with the GENIUS Act, putting stablecoin regulation within federal law.

These regulatory advances, combined with central bank experiments like BIS-backed Project Agorá and Asia’s mBridge pilots, aim to compress settlement times from days into seconds. For RWAs, this environment minimizes risk and enhances collateral mobility within global markets.

With $28 billion tokenized by now, and chains like Stellar and XRP Ledger securing nearly $1 billion of that, 2025 is becoming a turning point. If growth rates persist, such payment-focused blockchains could further extend their role as primary infrastructures behind global tokenized finance.

Currently, XRP is priced at $2.80, reflecting a marginal decline of 0.02%, while XLM is at $0.3636, showing a 1.21% increase over the past 24 hours.