Bitcoin’s Hashrate Holds Steady Near Record Highs as Network Prepares for Difficulty Adjustment

Bitcoin’s computational prowess currently hums at 825.85 exahash per second (EH/s), a gentle dip from its zenith of 844 EH/s recorded on Feb. 4, 2025. The network’s transaction queue, known as the mempool, continues to reflect minimal activity, while newly minted blocks materialize slightly quicker than the protocol’s 10-minute target.

Foundry Leads Mining Race: Four Pools Generate 78% of Bitcoin’s Computational Power

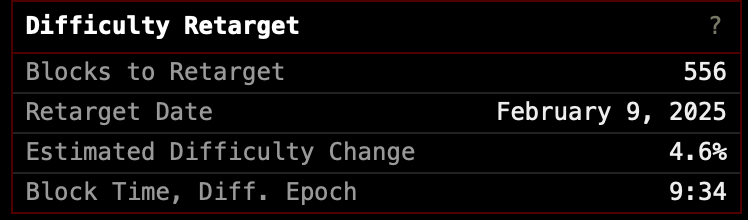

As of Feb. 5, 2025, the rhythm of block creation has settled at an average of 9 minutes 36 seconds. Should this brisk pace persist, the protocol’s self-adjusting mechanism will enact a 4.6% upward recalibration in mining difficulty by Feb. 9—a shift estimations now deem probable. Notably, data from hashrateindex.com reveals Bitcoin’s seven-day simple moving average (SMA) scaled to a historic peak of 844 EH/s just one day prior, highlighting the network’s dynamic adaptability.

Source: hashrateindex.com

As of 1:20 p.m. ET Wednesday, Bitcoin’s transactional queue coasts along with 12,957 pending confirmations—a backlog spanning roughly eight blocks. Miners currently reap $57.56 per daily petahash per second (PH/s) in hashprice, a figure modestly retreating from recent monthly highs yet comfortably eclipsing the Jan. 5 benchmark. Simultaneously, high-priority fees linger at 4 satoshis per virtual byte (sat/vB), reflecting subdued network strain.

Four mining collectives command the computational arena: Foundry reigns supreme with 260 EH/s (32.4% of total output), trailed by Antpool (20.21%), Viabtc (14.85%), and F2pool (10.73%). Secpool, MARA Pool, Spider Pool, SBI Crypto, Luxor, and Braiins Pool complete the hierarchy. Bitcoin’s ecosystem thrives on equilibrium: miners calibrate efforts against oscillating rewards, while transactional demand whispers rather than shouts. The current lull in fee pressure and hashprice’s tempered glide reveal a network in momentary repose.

Source: bitcoin.clarkmoody.com/dashboard/

The impending difficulty hike, whatever it leads to, will compress miners’ margins, incentivizing efficiency upgrades or exits. Higher thresholds demand amplified computational investments, reshaping competitive hierarchies while reinforcing Bitcoin’s self-regulating architecture. If BTC prices stay low and the network difficulty spikes, it won’t be a good thing.

While Bitcoin’s recent block cadence maintains a brisk 9 minutes 36 seconds, a curious anomaly recently emerged: a glacial 88-minute gap separated blocks 882,331 and 882,332. Data from Dune Analytics reveals four such sluggish intervals exceeding 60 minutes in February 2025—quirks in an otherwise rhythmic cryptographic clockwork.