Bitcoin treasury companies acquired 244,991 bitcoin in the first half of 2025: K33

This is a segment from the Empire newsletter. To read full editions, subscribe.

We’re over halfway through the year, so let’s do a little recap, shall we?

I mentioned K33’s H1 report in an intro the other day, but there’s a lot of interesting data to digest.

Such as the fact that the bitcoin treasury companies acquired a whopping 244,991 bitcoin by the end of June, which marked the official transition from H1 to H2.

Not to mention that the number of treasury companies, perhaps unsurprisingly, almost doubled by the end of the first half. At the beginning of the year, there were 70 firms with bitcoin on their balance sheet, but that quickly ballooned to 134.

Source: K33

Companies from the US, Canada, Japan and UK are at the top of the list when it comes to companies pivoting to a bitcoin treasury strategy, but the total sum is made up of companies from 27 countries, according to K33. That gives you a rough idea of how global this is, though the US tops the chart with 41 public companies.

But it’s not all about bitcoin treasury firms or even just bitcoin. A lot has happened this year, as both Securitize CEO Carlos Domingo and Bitwise CEO Hunter Horsley were eager to point out to us just this week.

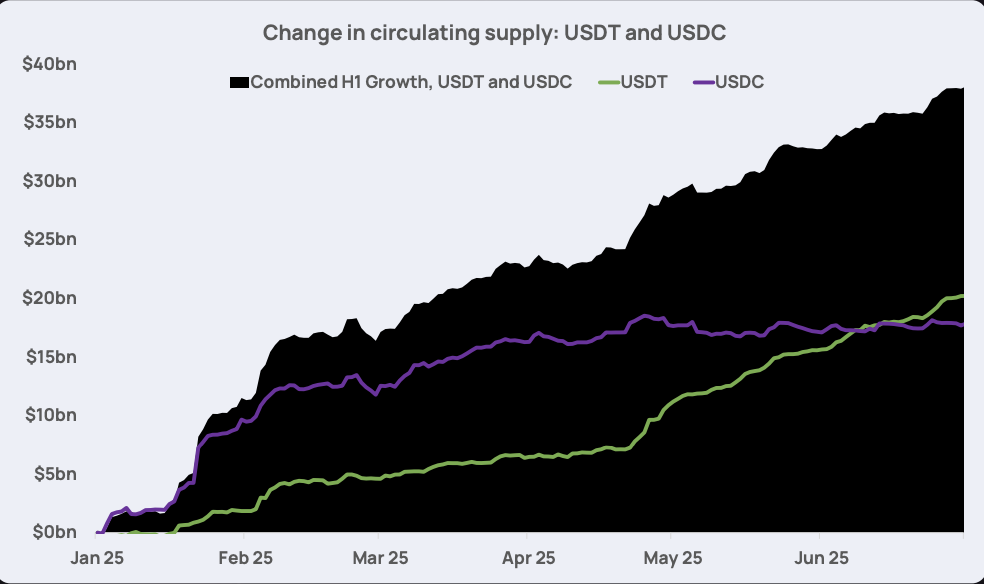

In the first half of the year, USDT and USDC’s circulating supply grew by $38 billion as folks flocked to the stablecoin narrative.

Source: K33

Source: K33

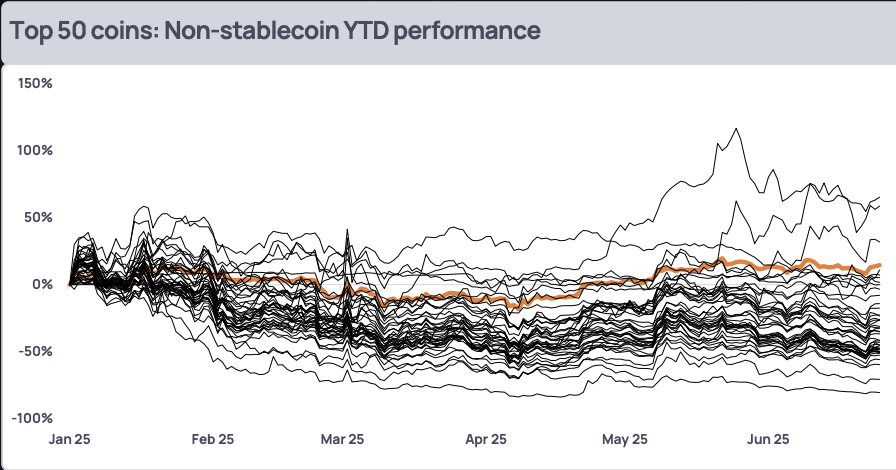

Unfortunately, if you take stablecoins out of the mix, then only nine of the top 50 cryptos saw positive returns in H1, showing that altcoins are still struggling to find their footing in a market dominated by bitcoin and stablecoins.

Of that nine, K33 noted that three specifically outperformed bitcoin: XMR, HYPE and SKY.

Source: K33

Source: K33

So it looks like the momentum still isn’t there for an altcoin season. Looking ahead though, there may be some hope on the horizon if some of these altcoin ETFs are approved, which could happen by the end of this year, as we previously reported.