Arbitrum Price Jumps 25% As Institutions Bet on Tokenized Assets

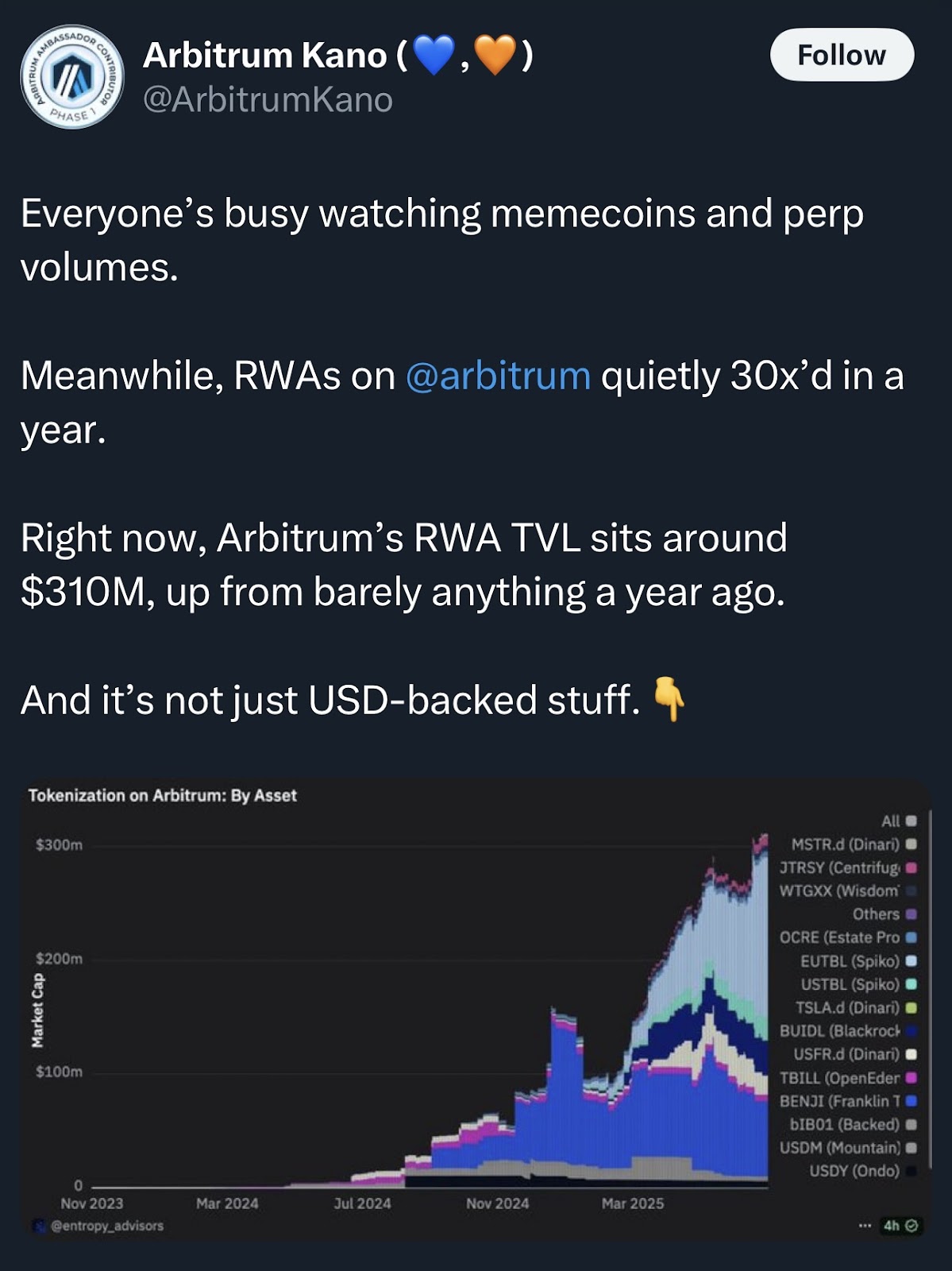

Arbitrum’s RWA (Real-World Asset) market is surging, and so is the Arbitrum price. Over the past week, total value locked in tokenized assets on Arbitrum has grown beyond $310 million, according to Messari and Entropy Advisors.

This marks a 30x rise from July 2024, a sign that institutions and on-chain users are turning to Arbitrum for more than just low fees or meme coin speculation. During that time, the price surged 25%.

At press time, Arbitrum price was $0.40, sitting just above a key Fibonacci level and approaching a major resistance at $0.5160.

Tokenized Assets Make the Bulk of Arbitrum’s Popularity

Multiple ecosystem participants have mentioned Arbitrum’s rapid rise in tokenized assets. These include tokenized US Treasuries, equities, ETFs, and real estate. Projects like OpenEder, Spiko, and Ondo are leading the charge.

One tweet from Market analyst @CryptoBusy noted that RWAs on Arbitrum are “exploding,” while @ArbitrumKano highlighted that the network’s RWA TVL is up from almost nothing to $310M in one year.

Tokenization on Arbitrum is growing- Source: CryptoBusy

This growth is part of a larger shift.

RWA TVL growing- Source: Arbitrum Kano

Holder Count Remains High

Even during crazy price swings, one thing has stayed consistent: the rising number of ARB holders.

Santiment data shows that the total number of unique addresses holding ARB has moved past 2.03 million. Yes, the holder count dipped a bit over the past few days, but the charts are still roaring.

Holder count increasing still- Source: Santiment

This steady climb since early 2025 shows strong wallet-level interest, especially during periods when price action was flat. This metric shows that despite the choppy price action.

ARB holders are still optimistic, and they might just be getting their due. High holder count signals long-term belief in the asset and often indicates strong base-level demand.

While some short-term exits happened in May and June, the curve has resumed its upward trend, suggesting that confidence remains.

Open Interest Signals Strength

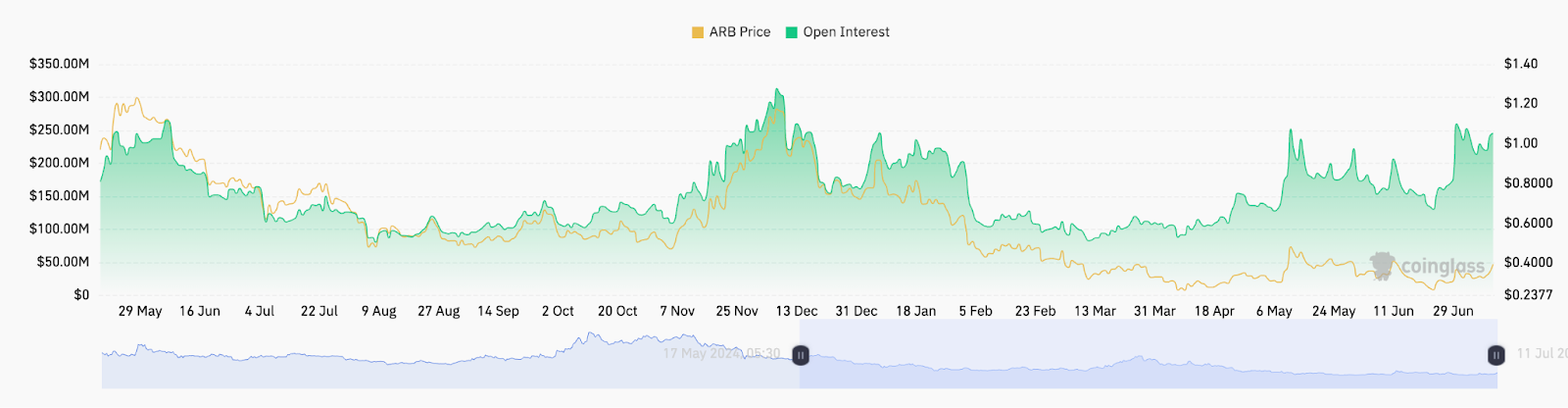

Alongside the tokenization surge, futures markets are heating up. CoinGlass data shows a sharp rebound in Arbitrum open interest.

After months of flat derivative activity, traders are now increasing exposure, possibly betting on a sustained move above $0.42.

ARB open interest- Source: Coinglass

Open interest measures the number of outstanding futures contracts. Rising open interest, especially when paired with price increases, suggests traders are opening long positions and expecting upside.

If this metric continues to grow in parallel with price, it could push the Arbitrum price closer to the next major resistance.

Fibonacci Chart Shows $0.5160 as Key Level

From a technical angle, Arbitrum’s price is bouncing off a clean Fibonacci structure. The recent swing low around $0.2525 (early June) and the swing high near $0.5160 (May top) give us the key retracement levels.

Arbitrum price chart- Source: TradingView

The current rally has broken past the 0.618 Fib level at $0.4116, a bullish sign. If momentum holds, $0.45 (0.786 level) and then $0.5160 could be next.

Fibonacci retracement is a charting tool that shows likely support or resistance based on key ratios (like 0.382, 0.5, and 0.618). These levels are watched closely by traders for breakout setups or profit-taking zones.

A clean break above $0.45 may push the Arbitrum price toward a full retrace of its May sell-off.

While macro market conditions are still evolving, Arbitrum’s RWA boom, high holder count, and strong technicals create a solid backdrop.

The invalidation for this bullish setup lies near $0.352 (Fib 0.382) and then deeper at $0.3147, both of which acted as support during the June consolidation.