AI SHIB price prediction for July 31, 2025

Shiba Inu (SHIB) appears to be regaining market traction following renewed interest from large holders, surging on-chain metrics, and a wave of short-term optimism supported by technical indicators.

At the time of writing, SHIB is trading at $0.00001382, up 15.78% over the past seven days and 6.28% in the last 24 hours, with its market cap swelling to $8.14 billion, up from $7.03 billion one month ago.

According to Finbold’s AI price prediction model, which factors in five key technical indicators, SHIB is projected to hit $0.00001450 by July 31, implying a potential upside of 4.84% from current levels.

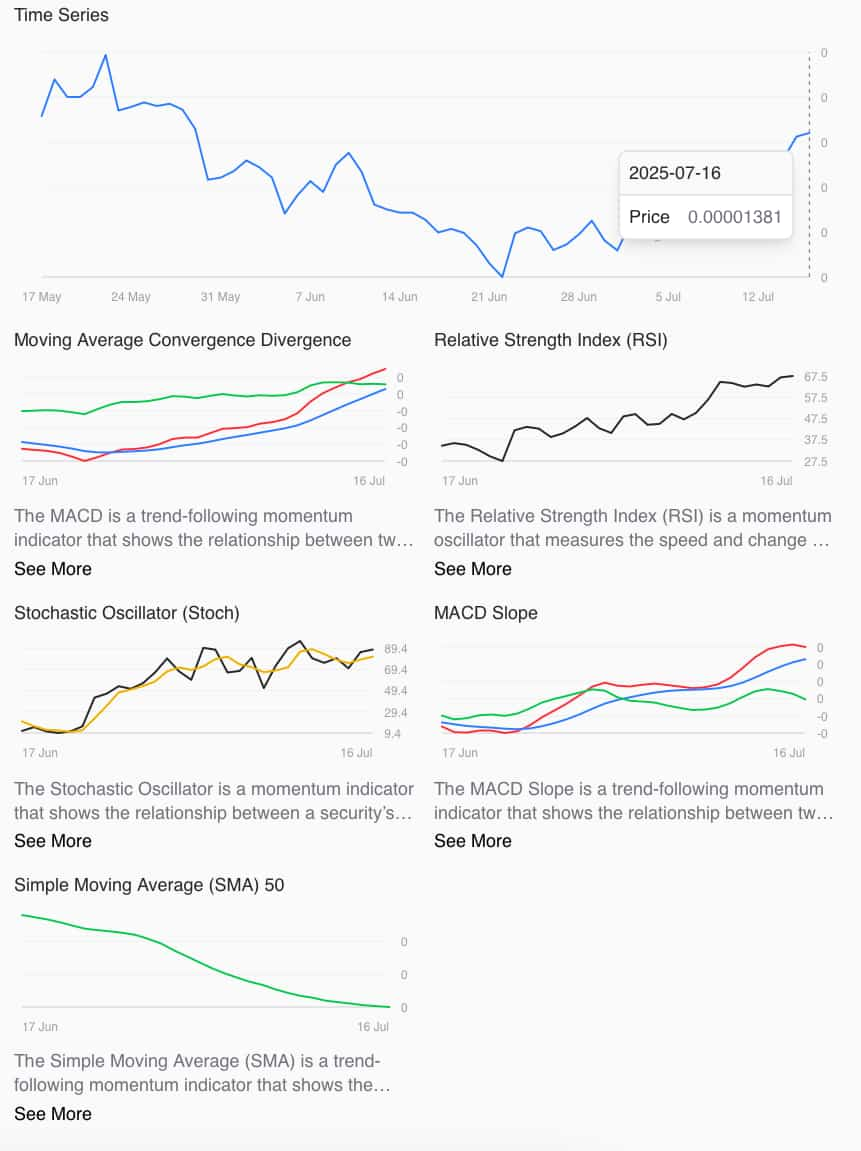

The prediction was computed using a multi-indicator framework that includes the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), Stochastic Oscillator, MACD Slope, and 50-day Simple Moving Average (SMA).

Shiba Inu price prediction analysis

While the AI forecast signals a continuation of upward price momentum, technical charts show a more nuanced picture of strength building, alongside early signs of possible near-term exhaustion.

Momentum has turned decisively positive across multiple indicators. The MACD and its slope both show widening divergence between short- and long-term trend lines, confirming that bullish momentum is increasing.

Similarly, the RSI has climbed steadily to a reading near 67.5, approaching the overbought threshold of 70.Notably, SHIB’s last major RSI peak at these levels preceded a two-week consolidation in May, hinting that while momentum remains bullish, a pause or minor pullback could be imminent if RSI breaks higher without volume support.

The Stochastic Oscillator, another widely watched momentum signal, is hovering in the 70–90 range. While this typically confirms strong buying activity, it also tends to flash caution during parabolic moves. Nevertheless, the absence of any bearish crossover keeps the door open for further gains.

Perhaps the one lagging component is SHIB’s 50-day SMA, which remains largely flat after a prolonged decline. However, price action has recently broken above this trendline for the first time in weeks, often an early reversal signal for assets emerging from prolonged downtrends.dynamics

SHIB trading volume

Beyond the charts, market structure continues to strengthen. Trading volume in the last 24 hours reached $331.13 million, a 27.21% jump that supports the current price action. The steady return of liquidity coincides with increased whale wallet activity and a rise in decentralized exchange transactions involving SHIB signals often seen at the start of medium-term trend reversals.

All told, Shiba Inu’s outlook appears cautiously bullish in the second half of July. The AI model’s projection of $0.00001450 represents a modest upside but aligns with current momentum. However, the RSI’s proximity to overbought levels and the flattening of the SMA suggest that bulls may need continued volume support and broader market tailwinds to sustain the rally.

If SHIB fails to build on its recent gains, support is likely to be found in the $0.0000126–0.0000130 range. But if current momentum holds and RSI breaks into overbought territory without divergence, the $0.000015 level may soon come into play, setting up a test of early May’s high.